The world around us is made up of different combinations. Things combine to form a whole that is greater than the sum of its parts. Whether it's a mobile phone with multiple gadgets packed into a small handheld device, or the three primary colours combining to create the various colours we see around us. Some things are just better together.

Similarly, investments in large caps, mid-caps, and small caps could be strategically combined to perform better together.

Presenting, Tata Multicap Fund that aims to combine the right ideas from various segments / sectors with the underlying philosophy of Growth At Reasonable Price.

The fund aims to invest at least 25% of it’s total corpus in each of these categories, aiming to provide you with a balanced portfolio, lower risk, and reasonable returns on your investment.

The fund aims to provide you with the opportunity to benefit from each market cap segment.

By investing across Market Cap segments, the Fund aims to provide you with exposure to the sectors that drive the economy, which means you don’t miss out on an opportunity.

Investors looking for diversification across market caps

Investors wanting to create wealth in the long run

Investors seeking exposure to mid and small caps as well as the stability of large caps

CHief Investment Officer (CIO) - Equities

Fund Manager

Head - Fixed Income,

Research Analyst & Fund Manager Overseas Investments

| Scheme Name | TATA MULTICAP FUND |

| NFO Date | NFO Opens: 16th January 2023 NFO Closes: 30th January 2023 |

| Investment Objective | The investment objective of the scheme is to generate long-term capital appreciation from a portfolio of equity and equity related securities across market capitalization. However, there is no assurance or guarantee that the investment objective of the scheme will be achieved. The scheme does not assure or guarantee any returns. |

| Type Of Scheme | An open - ended equity scheme investing across large cap, mid cap, small cap stocks |

| Benchmark | NIFTY 500 Multicap 50:25:25 TRI |

| Min. Investment Amount | 5,000/- and in multiples of 1/- thereafter |

| Load Structure | Entry Load: N.A. Exit Load:

|

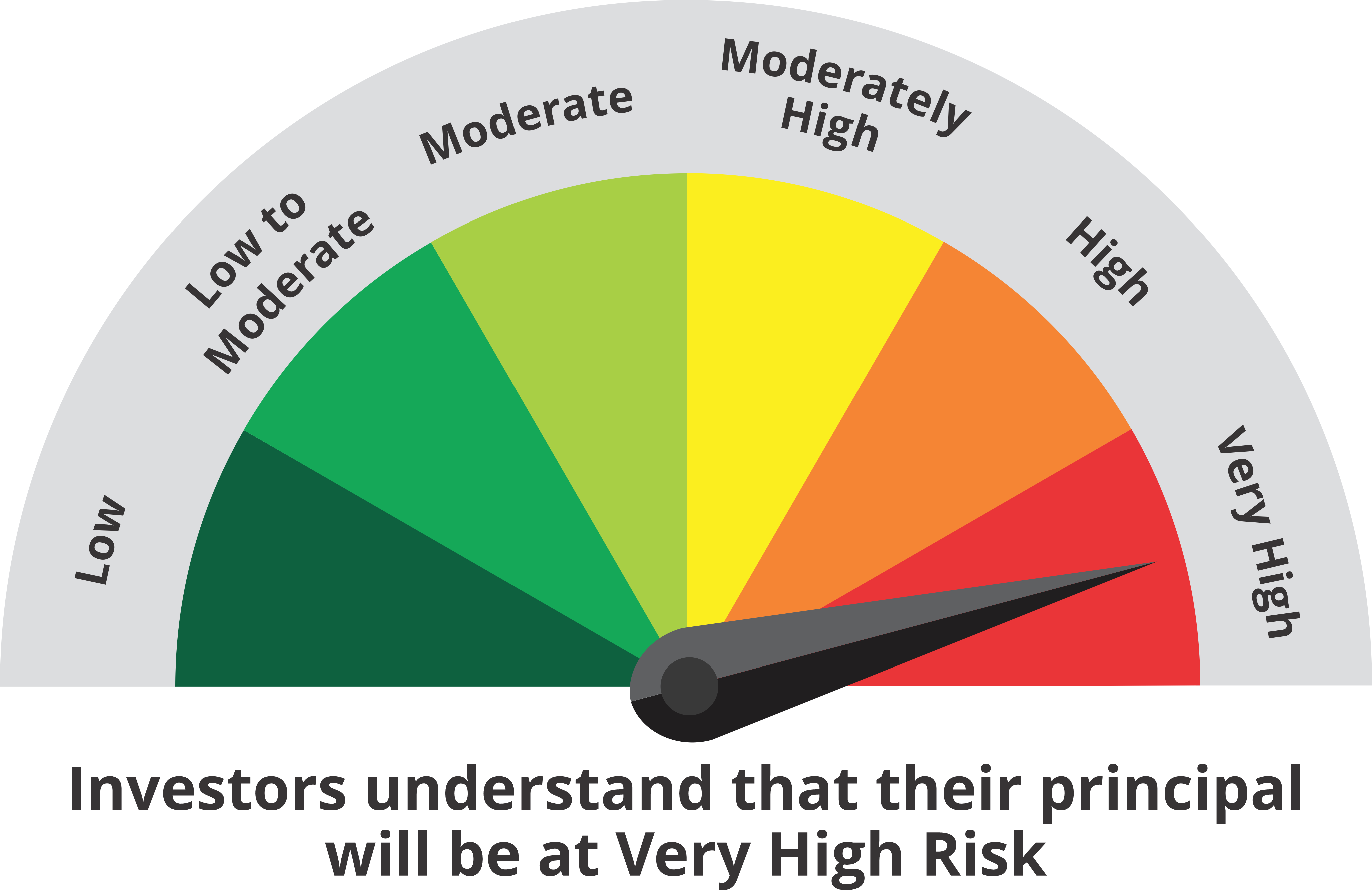

This product is suitable for investors who are seeking*:

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

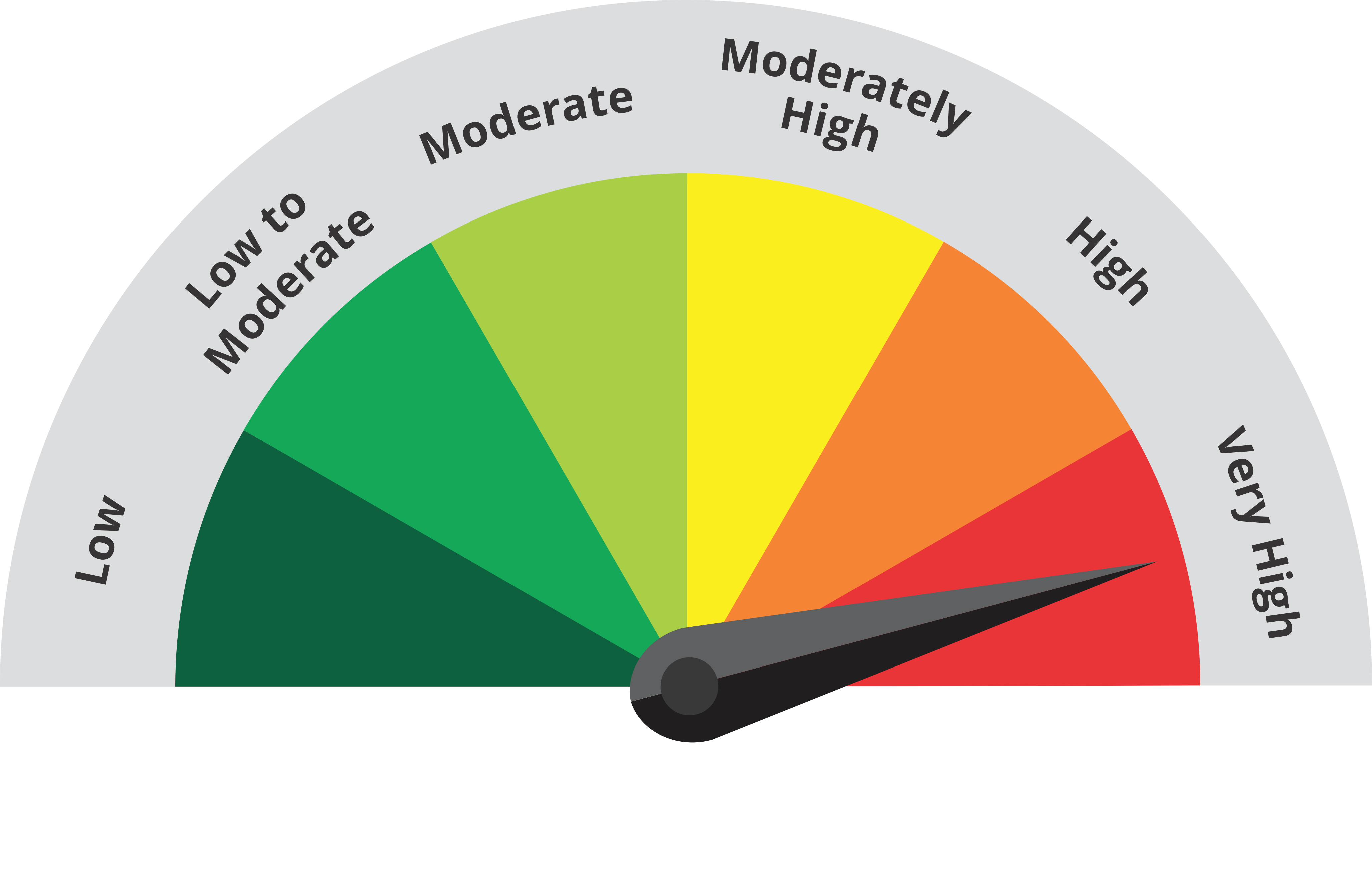

Scheme Risk O Meter

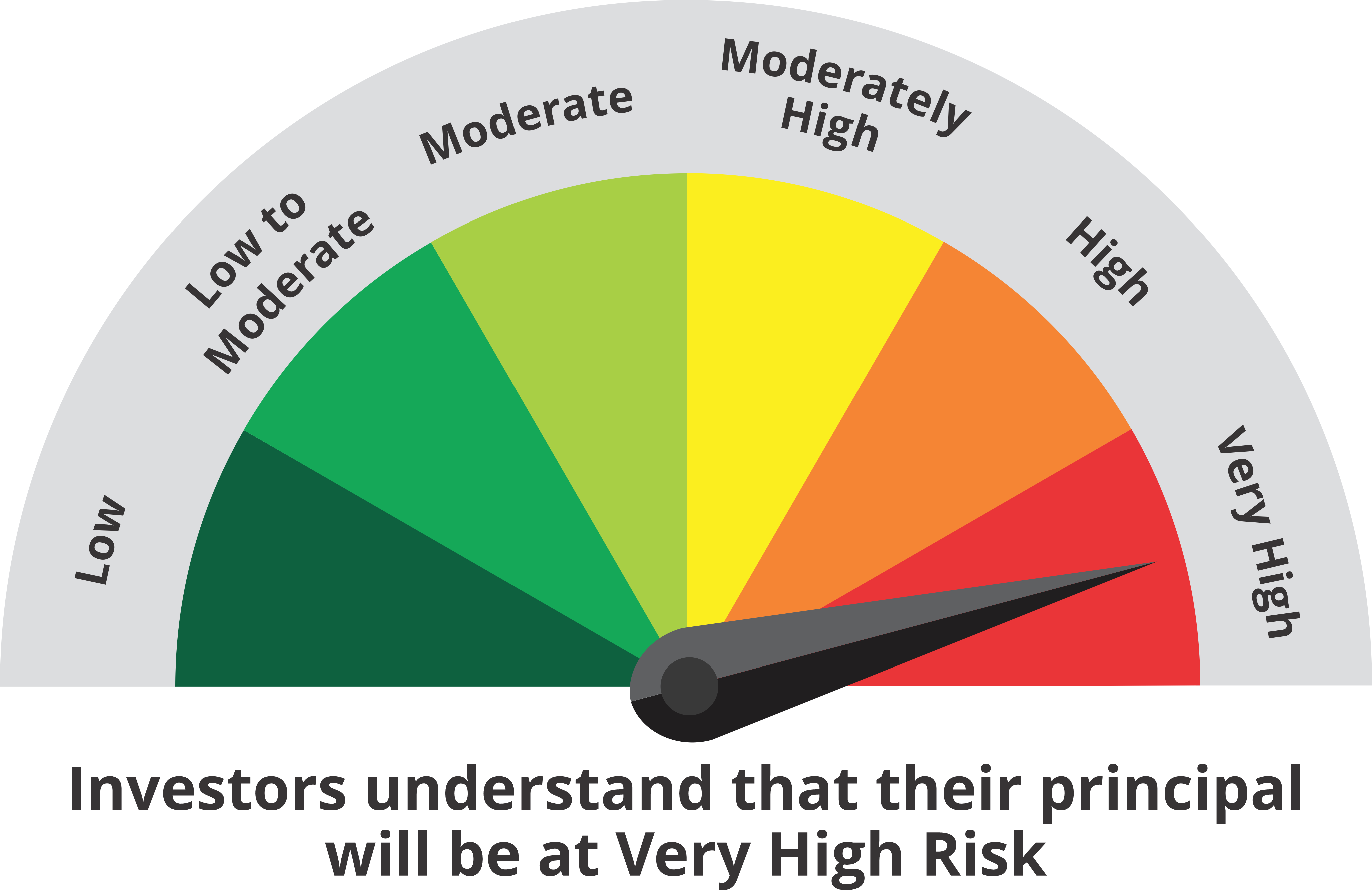

Benchmark Risk O Meter

(Nifty 500 Multicap 50:25:25 TRI)

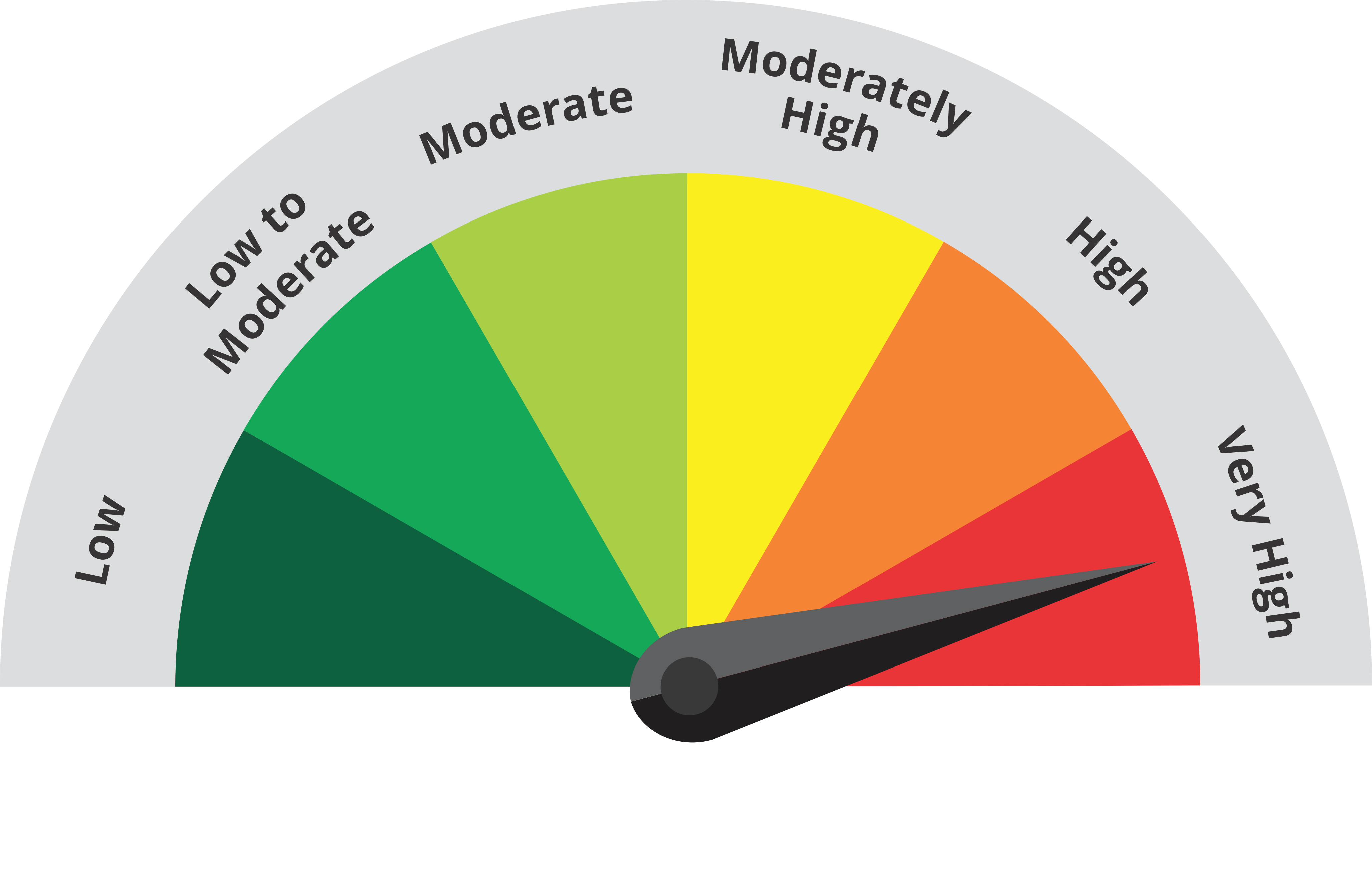

This product is suitable for investors who are seeking*:

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Scheme Risk O Meter

Benchmark Risk O Meter

(Nifty 500 Multicap 50:25:25 TRI)

# It may be noted that risk-o-meter specified above is based on the internal assessment during NFO. The same shall be reviewed and updated at the frequency specified by SEBI

At present the large Cap, Mid Cap & Small Cap companies are classified as below:

A. Large Cap: 1st - 100th company in terms of full market capitalization.

B. Mid Cap: 101st - 250th company in terms of full market capitalization.

C. Small Cap: 251st company onwards in terms of full market capitalization

Corporate Office Address:

Tata Asset Management Private Limited, 19th floor, Parinee Crescenzo, ‘G’ Block, Bandra Kurla Complex, Opposite MCA Club, Bandra (E), Mumbai – 400051